Tag Archives: Life Insurance Quotes

What are Life Insurance Quotes?

Posted in General

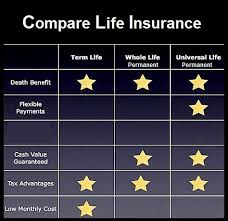

There Are Various Types of lifetime insurances. You must select the right one and also therefore it is important to do Compare Life Insurance. Article 80C of the Income Tax Act (ITA) provides people may decrease their taxation obligations by spending on types of devices. One particular such is term insurance. The sum charged to your entire life insurance policy strategy is responsible under section 80C to be given a complete tax advantage up to Rs. 1.5 lakh. All of payouts you earn from the insurance policies under Section 10(10D) are wholly tax-free (given that your payment is not going to exceed 10 percent of this overall A-Mount Assured). For those who have selected a health-related driver, such as some required condition or medical care procedure motorist, tax refunds underneath ITA 80D can also use.

Covering Liabilities

You Might Have had some amount of Financial support to accomplish your ambitions and also meet your aspirations while in the kind of grants, mortgages, along with other sorts of credit card debt. When it is college loans credit card defaults, coping-with those obligations might be an underlying reason for tremendous financial strain, with no stable income flow. Even in the event that you have the funds to pay off a part of your debts today, your family members will think of it’s impossible to manage those debts because to earnings decline while in the instance of of your terrible death. So, taking a time out for Compare Life Insuranceplan which ensures, actually in your absence, your family members will possess the fiscal option to reach your mortgage and loan payments rapidly.

Riders

You could even favor riders to degree Components for your life insurance policies and they can even choose Life Insurance Quotes. Many drivers can be found varying from serious illness to Accidental Total Permanent disorder, plus they protect you and your loved ones from cases in which your daily life insure might not always play with a role.

Concluding

Today health advantage policies and Life saving apps are still an absolute necessity. Lifestyle insurance is actually a risk security and optimization device that can support insured individuals along with their dependents to manage with several life events in a scope of varieties.